This new JCO column is compiled by Contributing Editor William V. Gierie, DDS, MS. Every few months, Dr. Gierie will introduce a pertinent article related to clear aligner therapy. Your suggestions for future topics or authors are welcome.

Clear Aligner Therapy: An Overview

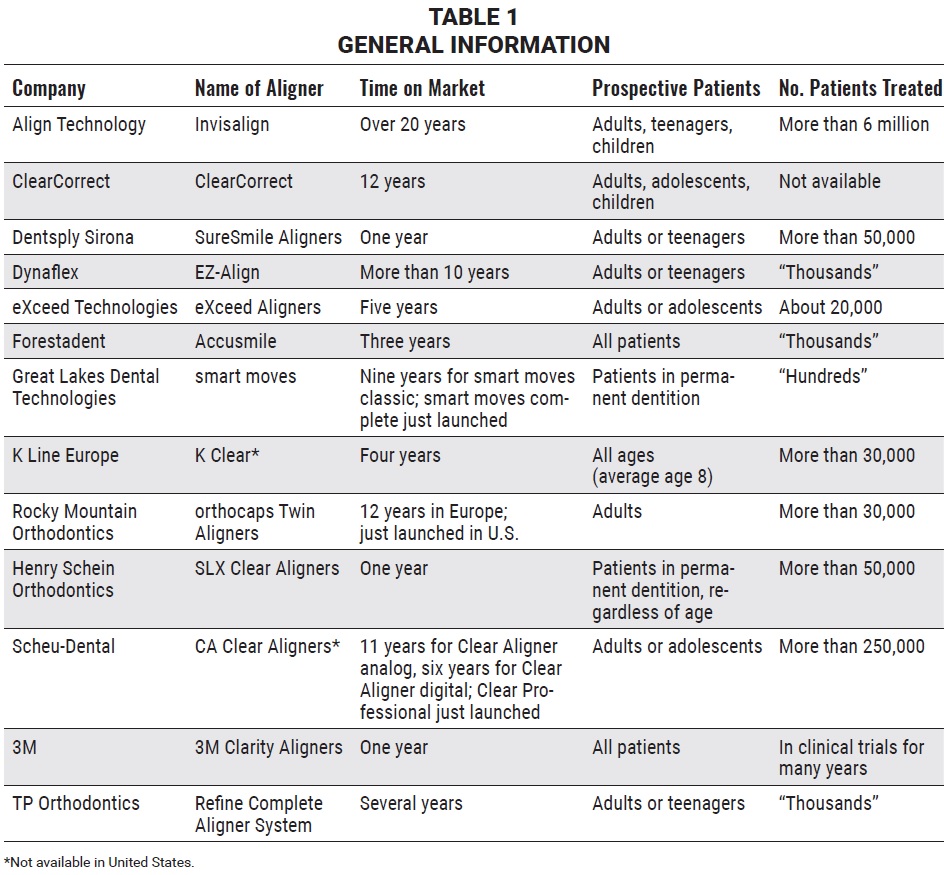

Digital clear aligner therapy (CAT) began in earnest when Invisalign became commercially available in 1999. Few in the orthodontic industry realized what an explosion of interest aligners would create and how many other companies would scramble to enter this space. Several dozen companies around the globe are now manufacturing aligners, with the number increasing every year. Other companies are providing in-house aligner platforms so that orthodontists can create practice-branded aligners to distribute to patients. Combine this with such direct-to-consumer approaches as Candid, Smile Direct Club, Smilelove, and Snapcorrect, and interest in CAT has never been higher.

Having paved the way for this treatment revolution, Invisalign is the dominant player in terms of brand recognition, research and development, manufacturing, training, and sales. It is unclear whether any of the competing companies or modalities will have a significant impact on the CAT market. Most likely, a rising tide will raise all boats, and the CAT industry will grow to penetrate segments of the market that have not previously sought orthodontic services.

Types of Clear Aligner Therapy

Similar articles from the archive:

- OVERVIEW Three-Dimensional Printing Technology August 2014

- OVERVIEW Intraoral Digital Scanners June 2014

- Creative Adjuncts for Clear Aligners, Part 1: Class II Treatment February 2015

Clear aligners can be either analog or digital. Analog CAT involves a physical model that is modified either by resetting the teeth or creating divots and voids in the model prior to vacuum-forming the aligner. Digital CAT starts with a three-dimensional scan of the dental arches, an impression, or a plaster model. All tooth movement is performed digitally, and the trays are fabricated from a series of 3D-printed models. Digital CAT has several advantages over analog CAT and is required for any corrections beyond mild spacing or crowding.

No company has yet offered a directly 3D-printed aligner, but that is the next evolution of CAT. Indeed, Dr. Sherif Kandil, founder of K Line Europe, stated in a July 11, 2018, interview that K Line could introduce 4D-printed aligners as early as 2019. Dr. Kandil holds a patent for 4D printing in orthodontics and is applying this technology in his research and development labs in Düsseldorf, Germany. The prospect of being able to directly print aligners whose properties change when they are introduced to saliva and heat in the oral cavity is an intriguing one.

Same-day aligner delivery will soon be made possible by quick digital scans coupled with artificial intelligence-driven digital tooth setups that can be modified and approved by the clinician in an interactive diagnostic exercise with the patient. This will allow truly customized, patient-centric treatment planning. Once consumers get a taste of same-day aligner delivery, they will gravitate to companies and orthodontic practices that can provide such a service. That is the future.

In the present, however, many of the major orthodontic companies, who have the advantage of large existing customer bases, have launched or will soon be launching CAT products. The following overview is not meant to be exhaustive, but to cover the principal players in the U.S. market, along with some notable providers based in Europe. The descriptions and accompanying tables are based on information supplied directly by the companies or from their websites. I have purposely omitted any direct-to-consumer operation in which the patient does not consult with a doctor face-to-face.

Align Technology

Invisalign is the juggernaut of the CAT category, with a 35% share of the adult orthodontic market and a 5% share of the teen orthodontic market, based on a second-quarter 2018 corporate fact sheet. More than 6.1 million people, including more than 1.4 million teens, have been treated with the Invisalign system, according to a third-quarter 2018 financial report. Still, the recent launches of numerous companies aimed at assisting doctors with in-house aligner fabrication seem likely to challenge Align Technology’s business model.

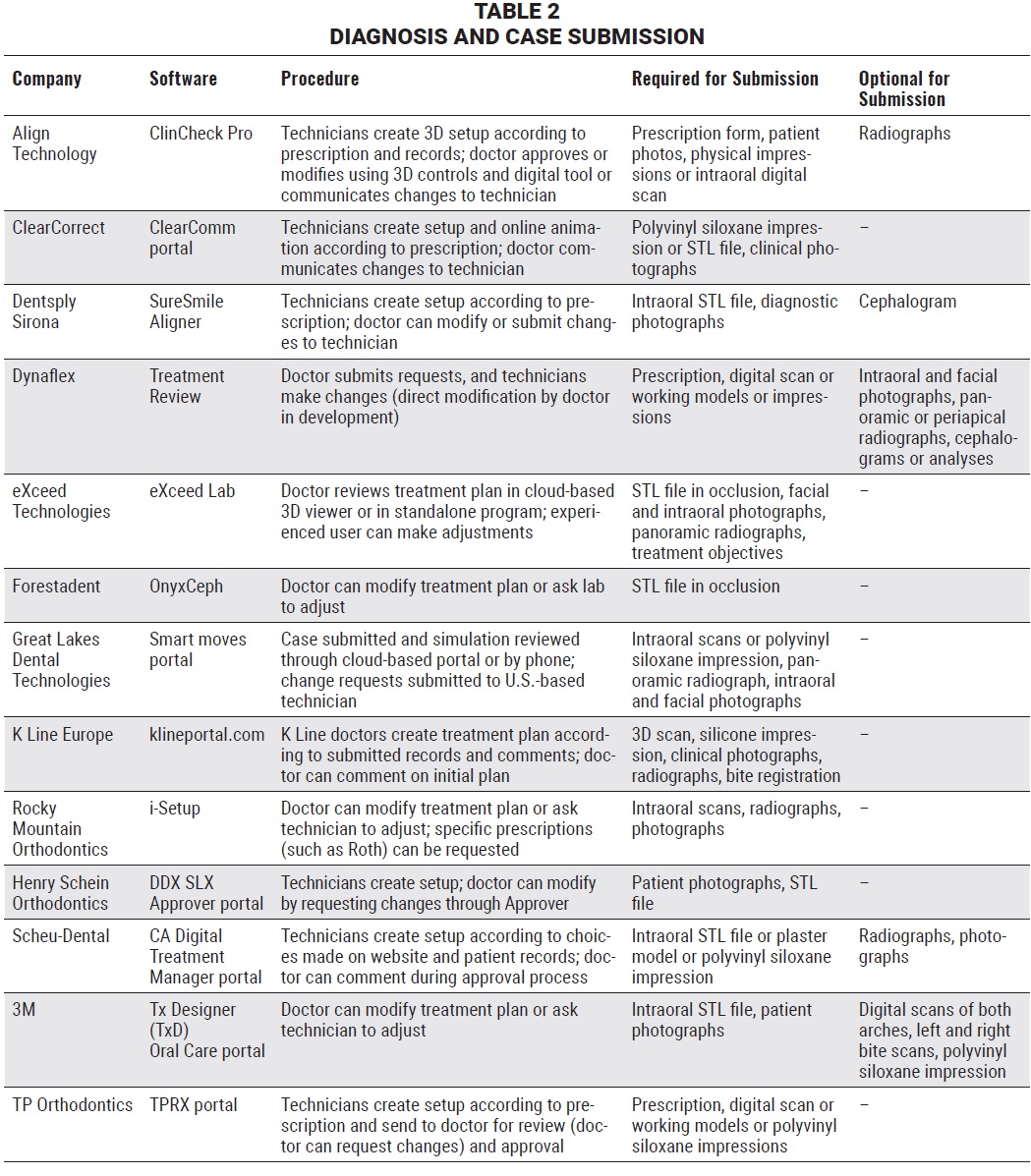

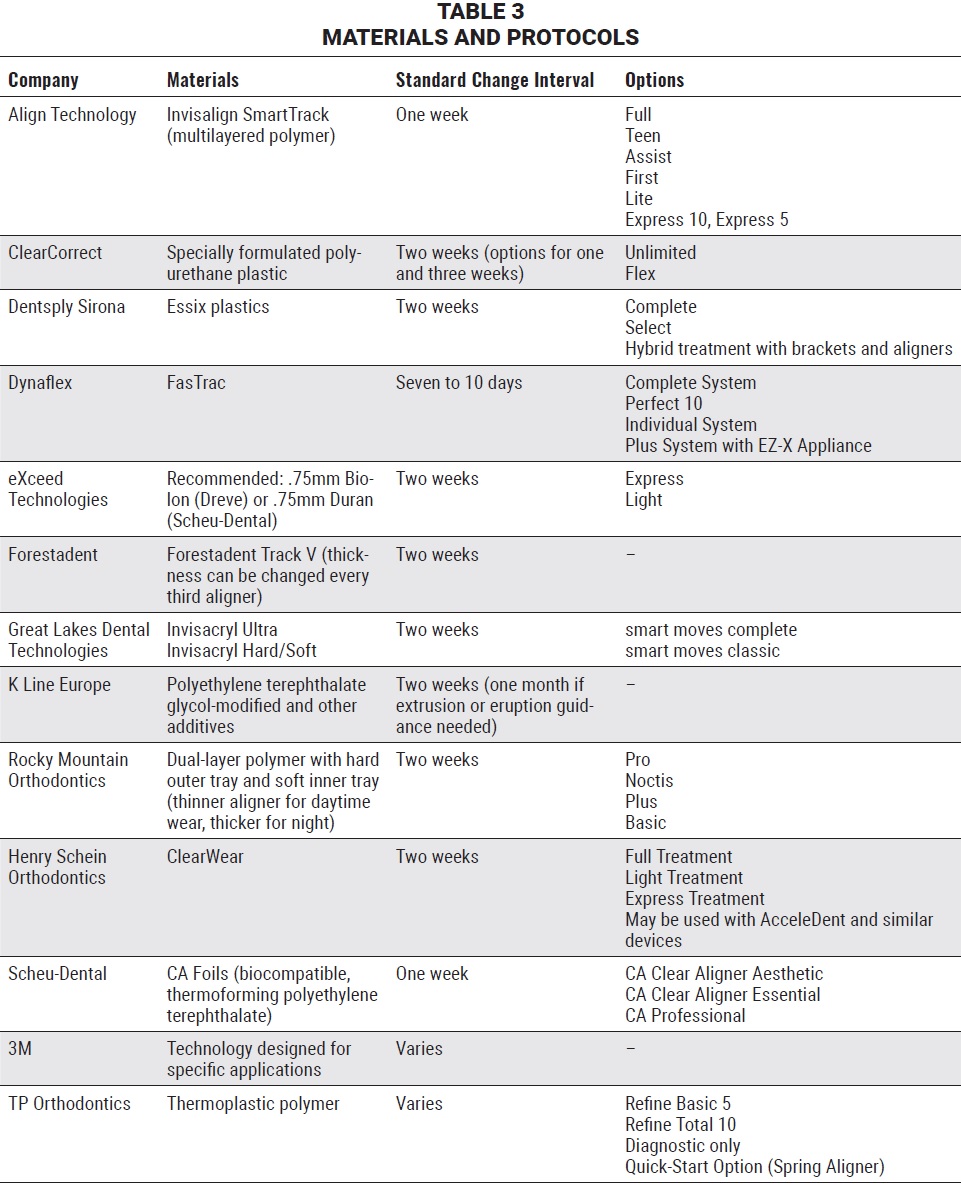

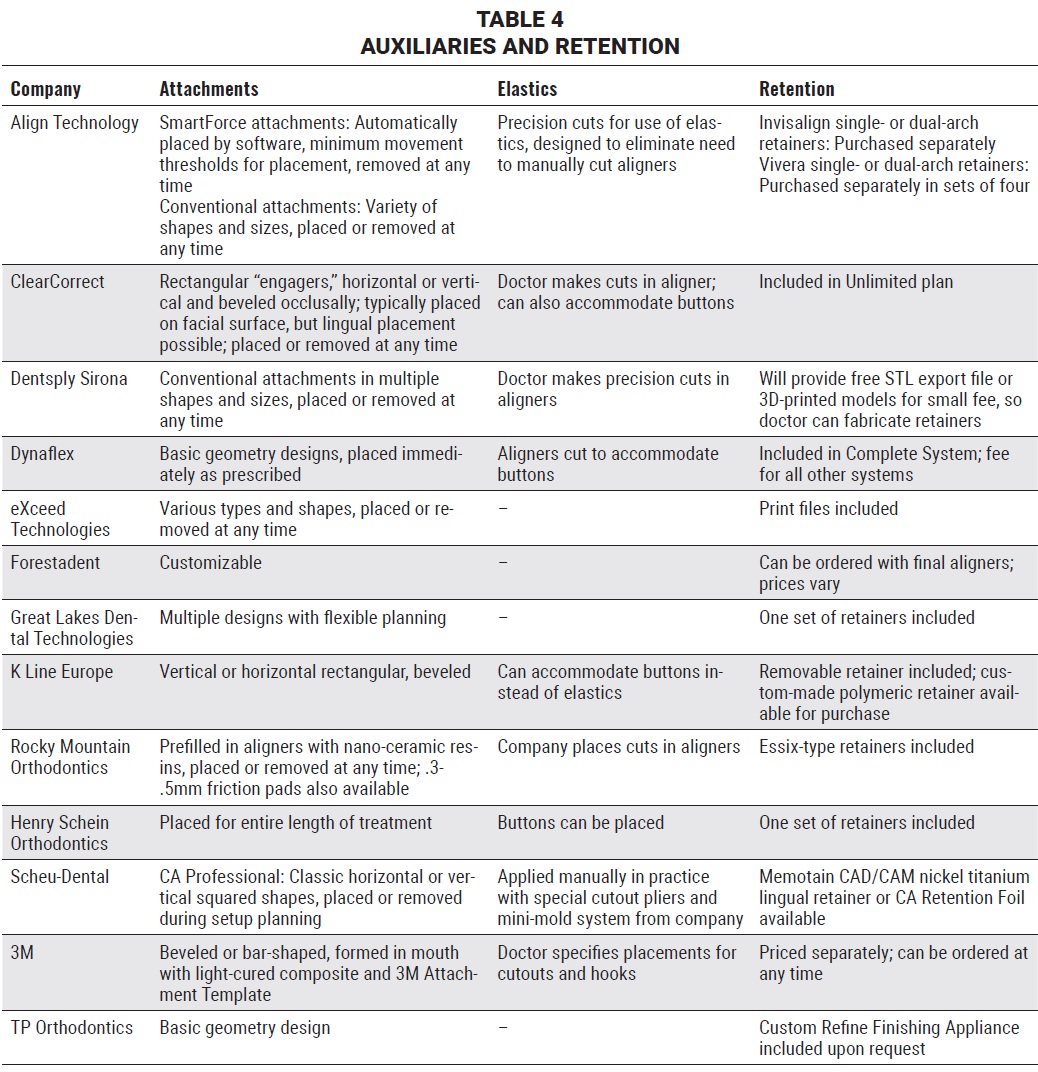

Align has invested heavily in research and development, continuing education, and marketing. Several of its innovations, including SmartTrack aligner material, SmartForce features, optimized attachments, Invisalign First, mandibular advancement, and one-week aligner changes, have enhanced CAT development and acceptance. Invisalign is essentially a closed manufacturing system, with treatment-planning tools provided to the doctor through ClinCheck Pro. With the 2011 acquisition of scanner manufacturer iTero, Align has been able to drive the development of scanner technology such as the Invisalign Outcome Simulator, which allows the doctor to demonstrate simulations and modify treatment plans with real-time patient input.

ClearCorrect

ClearCorrect was founded in 2006, making it one of the earliest CAT suppliers. In 2017, the company was acquired by the Straumann Group for $150 million. Although the majority of ClearCorrect’s customers are currently U.S. general dentists, Straumann’s international footprint will likely mean global expansion. ClearCorrect already operates in Canada, Europe, Israel, Australia, and New Zealand.

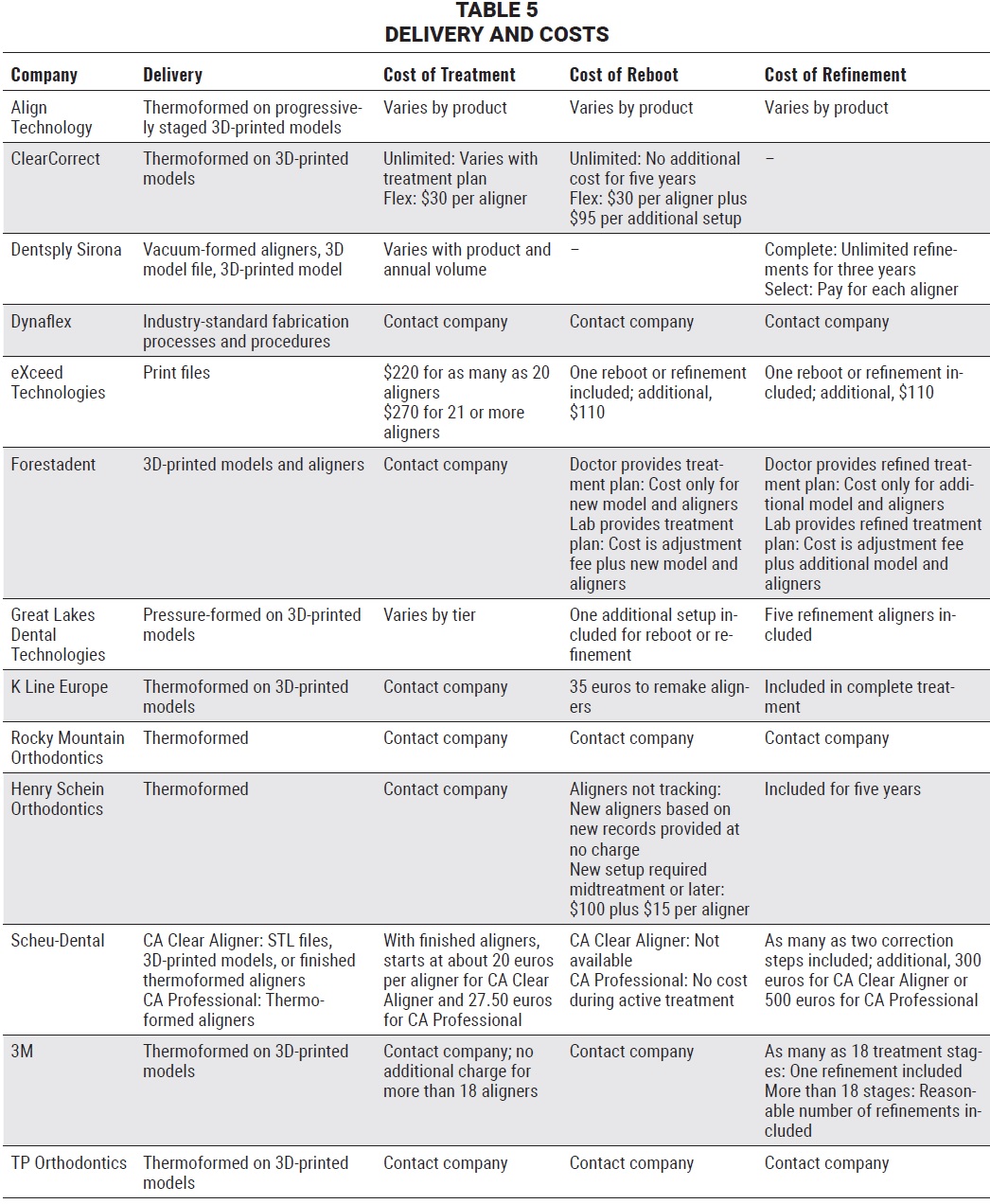

ClearCorrect offers either an Unlimited option that includes all aligners, revisions, and retainers for five years or a Flex option in which the clinician pays per aligner. Interproximal reduction (IPR) is allowed, and attachments called “engagers” can be designed through the web-based treatment portal. The greatest drawback I see in the software is the inability to make changes to the digital setup without working through a technician. This was one of the most frustrating aspects of Invisalign prior to the introduction of 3D controls.

Dentsply Sirona

According to Denstply Sirona’s website, the MTM Clear Aligner “is designed to treat the common minor anterior misalignments.” The system is available as an in-office option or a Service Center (turnkey lab) version focusing on the “social six” anterior teeth. MTM Clear Aligners use “open pathways” (blocked-out areas) and “force points” (pressure points or dimples added with pliers in the office) but no attachments. There is no limit on the initial number of aligners per case; one refinement or course correction is included.

Dentsply Sirona announced that it had acquired OraMetrix and SureSmile software in March 2018. SureSmile’s cloud-based 3D software, which the company has been refining for more than 15 years, can link cone-beam computed tomography (CBCT) with a 3D model from the intraoral scan to provide a true biological picture of the root structure. The software allows the doctor to place labial or lingual attachments and to move teeth in all planes of space, with automated staging of tooth movement. The 3D models can be printed in-house, exported to a commercial lab, or printed by SureSmile for aligner fabrication.

According to the Denstply Sirona brochure, SureSmile aligners are “ideal for cases requiring moderate tooth movement.” Packages include a Complete setup with unlimited aligners for as long as three years, or a Select system in which aligners are purchased as needed.

Dynaflex

In the Dynaflex EZ-Align system, the clinician views a digital setup on the web-based Treatment Review software. The EZ-Align aligner plastic, called FasTrac, was designed for strength, stain resistance, and ductility, according to the company. IPR and attachments are allowed, but changes must be requested from a technician.

Dynaflex Complete, aimed at moderate to comprehensive cases, includes as many as 20 trays per arch over six years of alignment and retention. The Perfect 10 system, for moderate cases involving the premolars, includes as many as 10 trays per arch. Individual trays can also be ordered for minor anterior tooth movement. The Plus System incorporates the EZ-X Appliance for lateral expansion prior to CAT. A second impression or scan is sent after the expansion for fabrication of the aligners. EZ-X can also be used independently of the aligner systems for mixed and permanent dentitions.

eXceed Technologies

The eXceed Aligners system is really a treatment-planning software: eXceed Technologies provides the design and manufacturing protocols, and offices or labs produce the models on 3D printers and vacuum-form the aligners. The appeal of this decentralized process is that it can be used without shipping, but the disadvantage is the inability to make high-quality, in-house aligners using the most up-to-date technology. The eXceed Lab software does have some interesting features, like being able to turn off the gingiva. Attachments and IPR are allowed; as eXceed’s website states, “Experienced users can also change the setups themselves.”

Two plans are available: Express, with as many as 20 aligners for minor tooth movement, and Light, with 21 or more aligners for moderate cases. One refinement is included. If the patient declines treatment after viewing the setup, the fee still applies.

Forestadent

Accusmile is also a digital treatment-planning service in which the practice prints the 3D models and fabricates the aligners; alternatively, Forestadent can do the printing and manufacturing. Technicians use OnyxCeph software to create the digital setups, and the doctor views these setups with Accusmile 3D software (apparently based on the Orchestrate 3D program). The website says the doctor can take over the tooth-movement planning or have a technician perform the digital setup.

Great Lakes Dental Technologies

Great Lakes’ new smart moves complete system, designed for full-arch treatment, uses a cloud-based portal for submitting and viewing cases; alterations to the setup are made by request to the technician. Smart moves complete uses Invisacryl Ultra, which is available only in a 1mm thickness (prior to vacuum-forming). Patients may find this material more cumbersome than the typical .75mm aligner plastic. In the older smart moves classic system, designed for anterior tooth movement, the patient wears a soft and then a hard tray for a maximum of three stages.

K Line Europe

K Line was founded in 2014; the K Clear aligner is available in 70 countries, not including the United States. According to Dr. Kandil, the doctor uploads the case information and reviews the treatment plan through a web-based portal. Comments can be added or the case confirmed, and the aligners are then shipped to the practice.

Ormco

Ormco uses the Insignia Advanced Smile Design software as the interface for its Insignia Clearguide aligners. The initial digital setup is performed by a technician, but the doctor can then modify tooth positions using the Insignia Approver program. A Heat N Bite bite-registration appliance is used for a midtreatment progress check—a rather low-tech solution with digital scanners so readily available. Each Insignia Clearguide case includes as many as 20 aligners.

Rocky Mountain Orthodontics

The orthocaps TwinAligners received U.S. Food and Drug Administration clearance in October 2018, although they have already been used in Europe for 12 years. Manufactured by Orthocaps in Hamm, Germany, this is a dual-layer system consisting of a hard outer tray with a soft inner tray. According to the company, the inner tray grips the teeth and expresses movement, so that fewer attachments are needed. A thinner aligner is used for daytime wear and a thicker one at night. The virtual tooth movement is performed in the i-Setup software, and the doctor can modify positions and attachments with 3D controls or by request to the technician. A unique feature of orthocaps is that the attachments come built into the aligners.

Four options are available: Pro, for comprehensive treatment; Noctis, for nighttime wear only; Plus, with 10 sets of aligners; and Basic, with five sets of aligners. Individual aligners can also be purchased.

Henry Schein

The SLX Clear Aligner system was launched at the 2018 AAO meeting in Washington, D.C. Henry Schein is emphasizing its philosophy of Sagittal First, which encourages clinicians to use Motion 3D appliances to correct Class II or III sagittal discrepancies prior to aligner treatment. Cases are entered through the Digital Dental Exchange DDX SLX Approver online portal. Technicians perform the digital setup, which can then be modified by the doctor.

Available options include Full Treatment, with 21-30 aligners for moderate to severe cases; Light Treatment, with 10-20 aligners for moderate cases; and Express Treatment, with fewer than 10 aligners for anterior tooth movement. One set of retainers is included.

Scheu-Dental

CA Clear Aligners are advertised as a three-splint system using three different material thicknesses. The softer trays (.5mm and .625mm) are worn for one week each, followed by the stiffer trays (.75mm) for two weeks per stage to increase pressure on the teeth over time. A unique feature is that the aligners are designed with 2-3mm of gingival coverage for improved anchorage and force transmission. The CA Smart 3D software is based on OnyxCeph 3D. Scheu-Dental will either supply the aligners or allow the clinician to outsource the digital setup and fabricate the aligners using material provided by Scheu. Based in Germany, this is one of the few CAT companies offering a training program for clinicians.

CA Clear Aligners can be ordered in one of two packages: Aesthetic for anterior tooth movement, with a maximum of five stages; or Essential for tooth movement involving the premolars, with a maximum of 10 stages and new impressions required after the fifth stage. The new CA Professional, for more complex cases, uses only medium (.625mm) aligners and a new stage every week, with intermediate impressions possible for midcourse corrections after 20 stages.

3M

Also launched at the 2018 AAO annual meeting, 3M Clarity Aligners are suitable for minor to moderate malocclusions in the permanent dentition. On May 4, 2018, 3M announced an exclusive North American license with uLab Systems treatment-planning software, which can import 3D digital scans and develop a treatment setup in as little as 10 minutes. The uLabs software allows auto-segmentation after the clinician identifies the teeth, or the company can generate a treatment plan through its 3M Oral Care Portal. Educational courses and webinars are offered through the 3M Healthcare Academy.

3Shape

3Shape’s business model differs from others in that it offers an Open Clear Aligner Workflow digital solution to clinicians and labs for creating in-house aligners or exporting the scans to outside manufacturers. According to its website, 3Shape represents more than 40 orthodontic treatment providers and the “widest range of integrated clear aligner providers.” The Clear Aligner Studio and Ortho Analyzer software programs include full-color treatment simulators. One notable feature is the ability to merge CBCT data with a scan.

TP Orthodontics

The Refine Complete Aligner System is “designed to correct minor to moderate anterior crowding or spacing,” according to the TP Ortho website. Cases are submitted through the TPRX portal. Options include Refine Basic 5 (as many as 10 trays) or Refine Total 10 (11-20 trays). Each option comes with retainers and a “finishing appliance” (a tooth positioner). A Quick Start Option employs the removable Spring Aligner to promote faster initial tooth movement.

Conclusion

There are many other CAT suppliers around the world that I was unable to review, including AirSmile, Alineadent, allRight, AngelAlign, Arc Angel, ClearCaps, Clearline by Protec Dental, ClearSmile Aligners, Compass OrthoAligner, DentCare Clear Aligners, Esthetic Aligner, Flash Aligners by Flash Orthodontics, Invisible Orthodontie by Uzege Ortho, iROK, Lyralign, Neo 3D, Nuvola by GEO, Open Aligner System by Kika Ortodontia, OrthoFolio, OrthoLab 3D, Perfect Aligner, Perfect Arch, Prestige Clear Aligners, RXaligners, Seq-Ret by tdl Precision Orthodontics, Smartee, SmileStyler, SmileTRU, SureCure, 3D-Aligner by EVIDENT, and Trueline. Most of these have not entered the U.S. market, where Invisalign continues to dominate.

As technology advances and 3D printers are able to turn out aligners with 4D properties cheaply enough for individual practitioners to make their own, the CAT market will be controlled by the best software. Unlike the Eastman Kodak Company, which ignored digital photography to protect its film business, the dominant players in CAT need to be ready for the day when they no longer manufacture aligners for the majority of their customers. Likewise, we clinicians need to prepare ourselves for the growing direct-to-consumer model of orthodontics. To quote author William Gibson, who coined the term cyberspace, “The future is already here—it’s just not evenly distributed.”

The products and suppliers listed in this article are trademarks of their respective companies, as follows:

Align Technology, Inc., San Jose, CA; www.aligntech.com.

ClearCorrect, Round Rock, TX; www.clearcorrect.com.

Dentsply Sirona, York, PA; www.suresmile.com/suresmile-technology/suresmile-aligners.

Dynaflex, St. Ann, MO; www.ezalign.com.

eXceed Technologies, Witten, Germany; www.exceed-ortho.com/aligners.

Forestadent GmbH, Pforzheim, Germany; www.accusmile.de.

Great Lakes Dental Technologies, Tonawanda, NY; www.smartmovesaligners.com.

K Line Europe, Düsseldorf, Germany; www.kline-europe.com.

Ormco Corporation, Orange, CA; www.ormco.com/products/aligners.

Rocky Mountain Orthodontics, Denver, CO; www.orthoaligners.com.

Henry Schein Orthodontics, Melville, NY; www.SLXclearaligners.com.

Scheu-Dental GmbH, Iserlohn, Germany; www.ca-clear-aligner.com.

3M, St. Paul, MN; www.3m.com/clarity.

3Shape, Copenhagen, Denmark; www.3shape.com/en/clear-aligners.

TP Orthodontics, Inc., LaPorte, IN; www.tportho.com/products/clear-aligner-systems.