MANAGEMENT & MARKETING

Strategic Financial Statements for Better Practice Management

[This column is compiled by JCO Contributing Editor Robert S. Haeger, DDS, MS. Every few months, Dr. Haeger presents a successful approach or strategy for a particular aspect of practice management. Your suggestions for future topics or authors are welcome.]

Industry-standardized financial statements can offer benchmarks for comparison to your colleagues, provide ongoing financial information for managing your practice, organize your expenses for review by outside consultants, prepare your practice for appraisals, and establish categories that make it easier to plan for reduced spending in lean years. This article will walk you through a process of creating financial statements that can achieve precisely those goals.

John McGill joins me in describing standardized expense categories for profit-and-loss statements. The files needed to integrate these changes are available to JCO subscribers at the end of the text, so that any practice using QuickBooks* can incorporate them into its accounting programs.

RSH

Strategic Financial Statements for Better Practice Management

The term "financial statement" actually refers to a number of reports that can be used to analyze the expenses and revenue of a business. The most common financial statements are an income statement (often referred to as a profit-and-loss statement) and a balance sheet (a summary of assets and liabilities). This article will focus specifically on how to customize an income statement for your orthodontic practice, thus improving your understanding of the practice's financial information.

Similar articles from the archive:

- MANAGEMENT & MARKETING A Strategic Orthodontic Marketing Plan, Part 1 December 2012

- MANAGEMENT & MARKETING Establishing an Optimal Pricing Strategy for Your Practice September 2014

- MANAGEMENT & MARKETING Increasing New Patient Starts by Analyzing Referral Sources and Treatment Coordinators March 2009

Creating Expense Categories

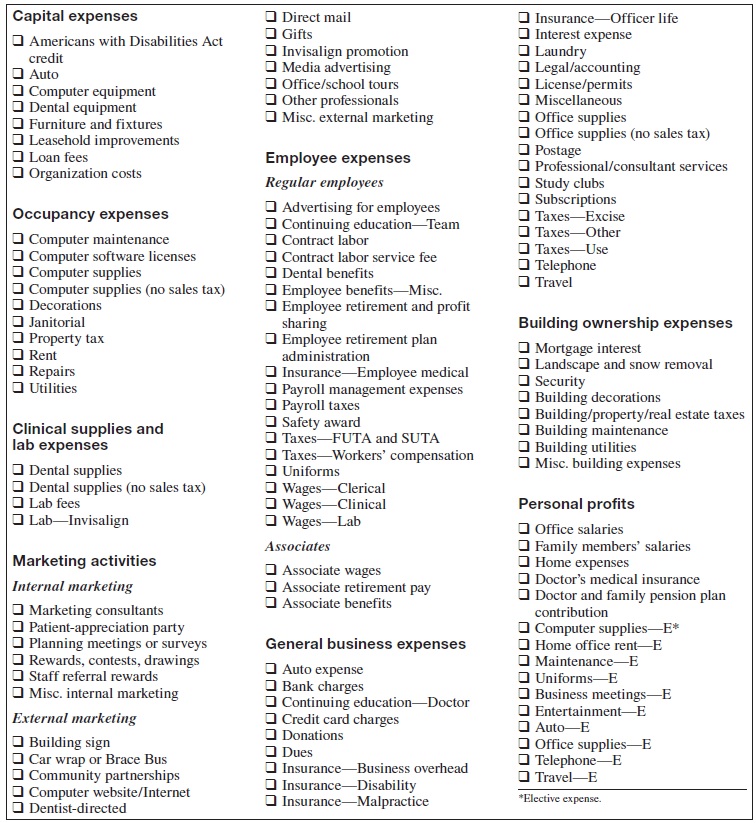

The first step is to create major expense categories and sub-accounts that will yield actionable metrics. We have identified eight major categories: capital expenses, occupancy expenses, clinical supplies and lab expenses, marketing activities, employee expenses, general business expenses, building ownership expenses, and personal profits. Each of these major categories can be broken down into a number of subcategories (and even sub-subcategories), offering incredible insight into the management of your practice (Fig. 1).

Fig. 1 Expense categories.

In the personal profits category, you will see what appear to be some duplicate subcategories, each followed by an "E". For example, computer supplies appears as a subcategory under both occupancy expenses and personal profits. "E" stands for "elective expense". Every company has elective expenses--items that may not contribute significantly to increased collections, but reflect choices made by ownership. Since any appraiser will remove these elective expenses when drafting income statements for your practice, you will be way ahead of the game if you record them on a monthly basis. Moving elective expenses to the personal profits category gives you a more accurate picture of your practice expenses and will also improve the effectiveness of any consultant you use. Your accountant can easily combine the elective expenses with like accounts when filing your tax returns.

You will also note that several expense accounts, such as computer supplies under occupancy expenses, have been marked "no sales tax". Breaking out these accounts makes it easier to keep track of use taxes, which can provide the documentation needed to avoid costly state audits.

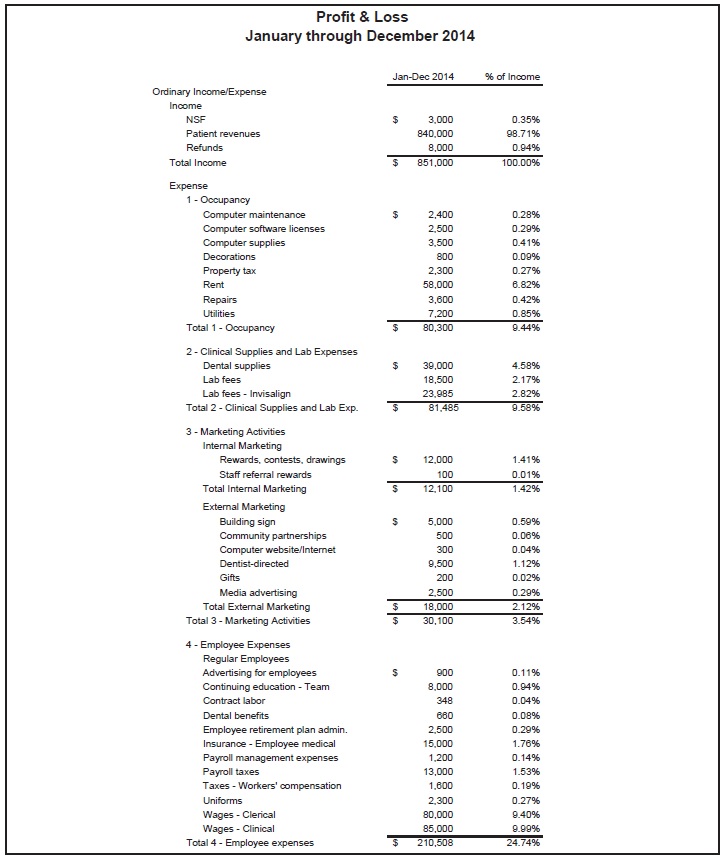

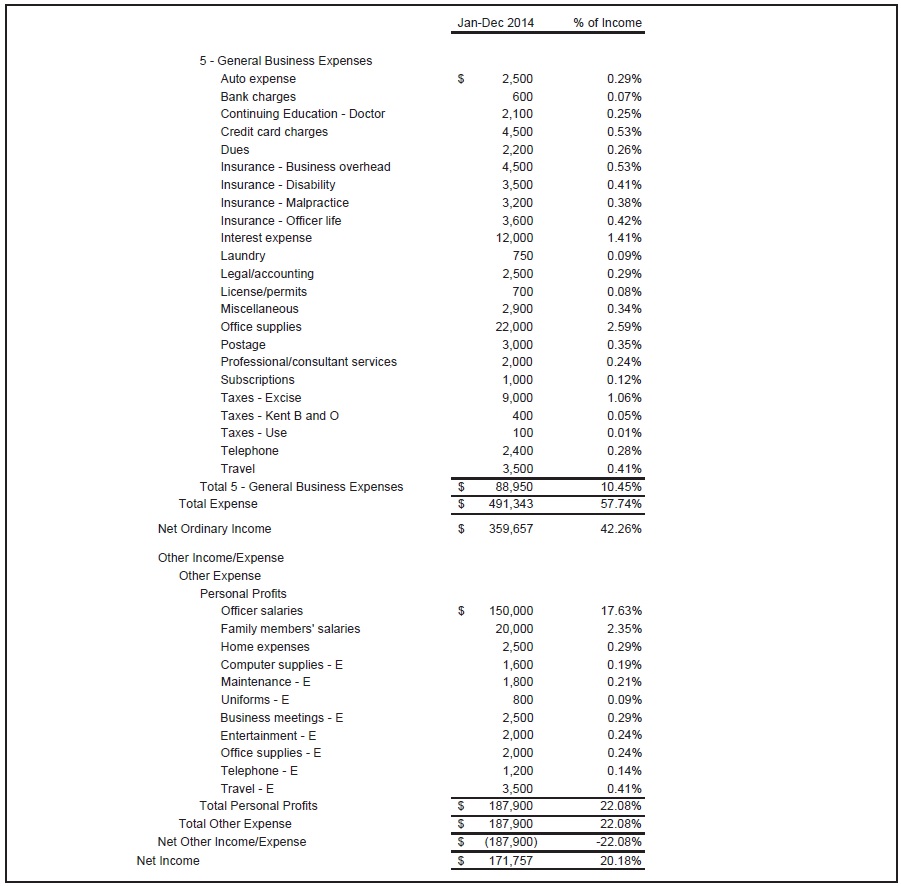

A typical profit-and-loss statement would look something like the sample shown in Figure 2 - page 1 and page 2. Note that this example does not use all the categories listed in Figure 1.

Transferring Credit-Card Expenses

Managing credit-card statements to ensure that expenses appear in the proper categories has always been a cumbersome process. Our solution is to use an Excel** spreadsheet to record and summarize all expenses by account. Although most credit-card companies offer applications for downloading information directly into QuickBooks, this is often a complicated process that requires many steps to assign proper sub-accounts. You will find it easier to start with the Excel file.

When your credit-card statement arrives, simply add an abbreviation for the proper expense category next to each item; your bookkeeper can then transfer the expenses to the Excel spreadsheet. The spreadsheet formulas will total the expense accounts by category, and your bookkeeper can simply enter the totals into QuickBooks when the bill is paid.

This downloadable spreadsheet includes three worksheets, two for office credit cards and one for a personal credit card. Any columns that are not used for a card in a particular billing period can be hidden to make the file more manageable for viewing and printing.

The "difference" cell can be used to help find errors or to record any personal expenses charged to a card. Such expenses can then be entered as a personal draw (counting against quarterly distributions from the practice S Corporation) or as a loan to the doctor.

Day-to-Day Application of Financial Statements

A properly organized accounting program will produce actionable income statements and balance sheets that are easy to manage and interpret. QuickBooks can generate a number of reports for the past month, quarter, or year, including such figures as percentages of collections, percentages of expenses, comparisons to prior periods, and budgets for each expense category. By examining these versatile reports, you will gain an immediate understanding of your practice's expenses and profits.

Several sections of the income statement shown Figure 2 - page 1 and page 2 illustrate areas that can add significant insight to your practice management (the numbers are fictitious and should not necessarily be considered as targets).

Income: This section tracks patient revenues, insufficient funds, and refunds. It's easy to pull out monthly and quarterly tax figures or to transfer the totals to a larger Excel file for a dashboard view of your practice.

Occupancy expenses: By detailing all the facility costs for your practice, you will see that these expenses extend far beyond office rent to include utilities, repairs, computer maintenance and supplies, and more.

Clinical supplies and lab expenses: You can determine the fixed cost of adding a single patient to your practice by dividing the total clinical and lab expenses by your number of starts during the same period. Unless your practice is at full capacity, this is your fixed expense for one additional start.

Marketing activities: This section is divided into internal marketing (which targets existing patients and staff) and external marketing (which targets people outside your office). The data found here will help you establish a marketing plan, set a budget, and make more strategic use of your resources. It is easy to say "yes" when someone asks you to sponsor a favorite program. But have you looked at this budget line item? Is a new sponsorship the most effective way to spend your external marketing dollars? You can only answer such questions if you itemize your marketing expenses and summarize them in a report.

Employee expenses: These expenses generally represent the largest portion of overhead. Since some offices choose to offer higher salaries while others provide more benefits, it is best for purposes of comparison to include both salary and benefit costs. This section will also be useful in conducting annual employee reviews and when evaluating the number of employees on staff. Dividing wages into clerical, clinical, and lab subcategories and separating general employee expenses from associate wages and expenses will allow much more meaningful tracking of all labor costs.

General business expenses: These are the items necessary to run an orthodontic practice. You will see that many are fixed expenses, which means their percentage of overhead will decrease as collections increase.

Building ownership expenses: Including all the costs and revenues associated with your building will tell you what you need to know to set rents and budget. For benchmarking purposes, however, we must treat all practices as if they were renters, as shown in Figure 2.

Total expenses: Most doctors don't know the true cost of operating their practices before any personal profits or elective expenses are paid. Any remaining expenses beyond this total expense line represent the amount of money that your practice spends on personal items.

Personal profits: This is where the doctor's income, family expenses, retirement investments, and elective expenses are totaled. It's important to understand that while these are expenses to the corporation, they are profits to you. If your practice is like mine, you may find it easier to pay personal expenses with corporate checks and code them as "personal loans". Placing these expenses under personal profits keeps them separate from business expenses, ensuring that they do not muddle your calculation of office overhead.

Capital expenses: A profit-and-loss statement does not include capital expenses, which are considered assets to the practice and are converted to expenses on depreciation schedules. Because some clinical procedures have capital-expense components, you will need to understand your balance sheet and depreciation schedule when evaluating the profitability of a particular appliance or technique.

Expanding Your Use of Financial Statements

Properly designed and standardized accounting programs like QuickBooks do not merely organize data for your accountant and tax returns, but offer a number of other possibilities as well.

Benchmarking: One of the most difficult aspects of managing a practice is understanding profitability. It may be useless to increase production or collections if you don't understand the proper ratios of expenses to profits. Standardizing your expenses allows you to easily compare your practice to other well-managed practices. Moreover, breaking down your expenses into major categories and detailed subcategories will allow you to delve deeper into specific items and perhaps change your spending approach.

Providing actionable metrics for consultants: Every consultant wants to quickly isolate areas in which he or she can help your practice. By fully analyzing your expenses and presenting them in a detailed, accessible format, you and your consultant can be far more productive in targeting areas of improvement.

Examining expenses over time: A profit-and-loss statement should include columns comparing your practice's expenses to those of prior years. It will compare the current month's percentages of collections to year-to-date percentages and automatically calculate the differences. QuickBooks also offers the ability to develop an annual practice budget and measure your actual expenses against that budget.

Marketing: The old methods of analyzing the costs of promotion, entertainment, business meetings, and office supplies are no longer sufficient; today, every practice needs a strong, proactive marketing strategy. By dividing your marketing expenses into internal and external efforts and identifying appropriate subcategories, you gain an immediate and detailed understanding of where your marketing dollars are going and what percentages of collections they represent. The income statement makes it much easier to target marketing efforts for improved return on investment.

Designing alternative financial statements: QuickBooks allows you to export your profit-and-loss statement into Excel and thus create two more reports to help manage your practice.

1. By substituting production for collections and replacing refunds with write-offs, you get a better picture of how insurance-company write-offs impact your overhead and labor costs.

2. By adding an expense line under occupancy expenses for principal payments toward loans, you will learn how much income really remains after all office expenses and loan payments have been subtracted. (This is referred to as a "sources and uses of cash statement".) Many doctors wonder why they don't seem to have as much money left over as the traditional profit-and-loss statement indicates. The cause is often unusually large principal payments.

Responding to a lean year: Let's say a year like 2008 comes along again (and it will). A well-designed income statement will make it much easier to pinpoint elective expenses and modify your spending patterns to stay lean and profitable under tough economic conditions.

Implementing the Changes in QuickBooks

Now you're ready to put what you've learned into action. If you already use QuickBooks, simply import the Excel spreadsheet from the JCO website, then edit your accounts by renaming them to match our new account names. When QuickBooks asks if you want to merge the accounts, click "Yes". Although your bookkeeper will have to make journal entries to move some expenses around, this procedure is fairly simple. You will then need to adjust your payroll accounts so that they are applied to the appropriate clerical, clinical, and lab categories. A subsection on associates provides valuable information to help assess the impact of adding more orthodontists to your practice.

It will take a few months to get fully comfortable with this new design. We believe the advantages will prove well worth your efforts.

Conclusion

A financial statement should pass the "one-minute test":: if you can't accurately determine your true practice overhead and profits within one minute, you need to implement the suggestions provided in this article. To summarize the benefits of this system:

- A well-organized profit-and-loss statement is a powerful tool for analyzing expense totals, budgeting, and projecting tax liabilities, allowing rapid adjustment of expenditures to address changes in cash flow.

- A standardized profit-and-loss statement provides valuable benchmarking potential for improving your practice-management decisions.

- A well-designed profit-and-loss statement allows quick and easy access to the data needed to create a strategic marketing plan.

- Separate breakdowns of elective expenses enhance your understanding of practice profitability, allow more accurate benchmarking comparisons, and make practice appraisals and meetings with consultants less costly and more productive.