Employee management is probably the most stressful part of running an orthodontic practice. To be an effective leader, you need to practice strong communication, establish clear expectations, and set target metrics for your employees. This article will focus on how such metrics can help you make smarter decisions about employee management from a financial perspective.

Communication Basics

To communicate effectively with employees and set realistic expectations, you need to focus on six areas:

- A strong hiring process, including proper screening of potential employees and solid initial training.

- Clear job descriptions and cross-training lists.

- A written office manual that establishes policies and expectations.

- Morning huddles.

- Monthly office meetings to articulate goals and action items.

- Annual or semiannual individual employee reviews.

Offices that do well in these six areas will demonstrate outstanding leadership in team management and eliminate significant mental stress. If any of these features are missing from your practice, I suggest you make efforts to incorporate them soon.

Similar articles from the archive:

Key Employee Management Metrics

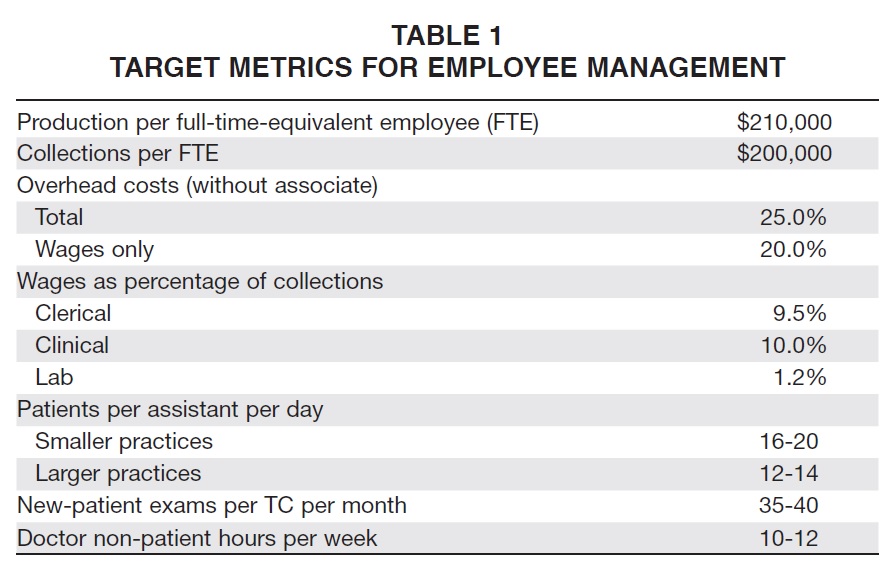

Both communication and financial metrics are vitally important for managing employees. The first metrics I examine are gross production per full-time-equivalent employee (FTE) and collections per FTE. "Full time" typically means 32-36 hours per week for a four-day-a-week office, or 40 hours per week for an office that is open more hours. The targets should be $210,000 in production per FTE and $200,000 in collections per FTE (Table 1).

The figure for collections per FTE is lower because orthodontic offices typically write off 5-7% of production (representing the financial impact of employees on overhead). I use production per FTE as the primary guide because some offices have higher write-offs. Employee targets should be based on the work they do, which is reflected in production. If your numbers are much lower than the targets--say, $150,000 in production per FTE--then either you are overstaffed or you have plenty of room to increase production without increasing the number of employees.

The next metric to look at is total employee overhead costs as a percentage of collections. Include wages, payroll taxes, retirement contributions, business taxes for employees (state and federal unemployment, Labor and Industries, and worker's compensation), staff continuing education, employee benefits (uniforms, medical insurance, dental insurance, and meals or entertainment), and payroll expenses. Your total overhead should be around 25% (without an associate). If you wish to simplify this calculation, you can evaluate only wages as a percentage of collections, with a target closer to 20%. But if you're like most practices, which use various benefits to make up an overall payroll package, focusing exclusively on wages can leave out an important part of your employee overhead picture. For anyone who is daunted by the idea of calculating total employee overhead, the easiest approach is to configure your QuickBooks accounts to track this information.1

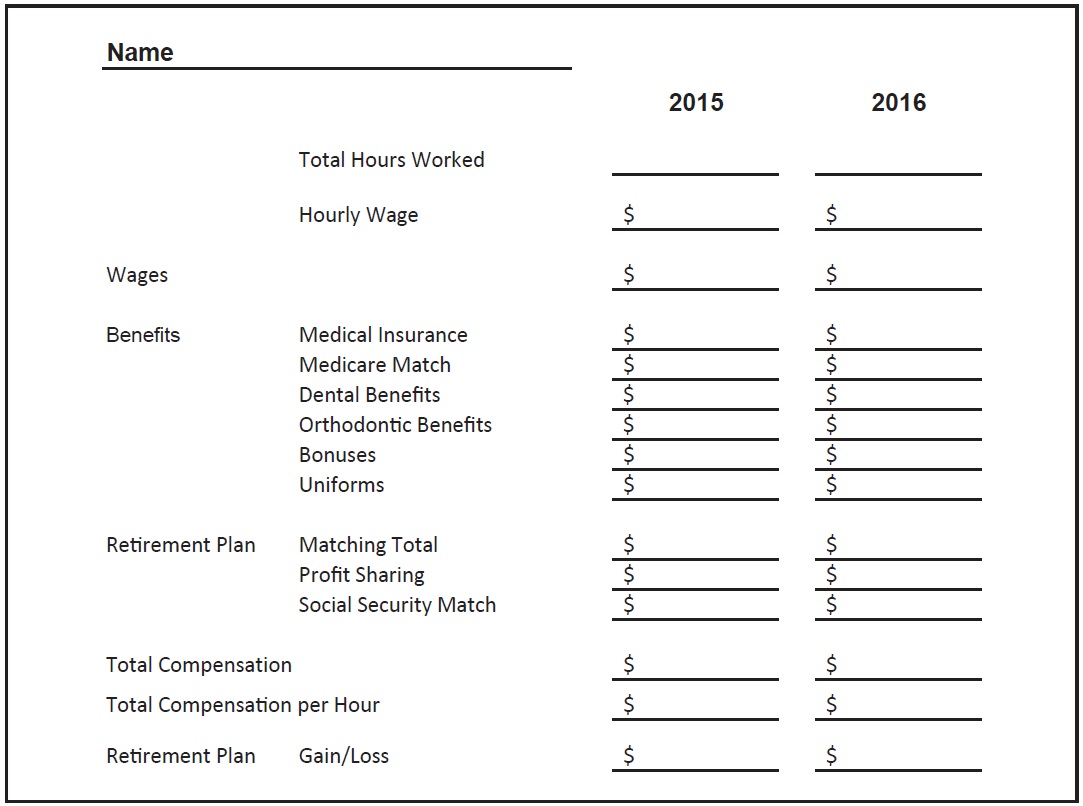

A total compensation worksheet for each employee should be maintained in an Excel spreadsheet and presented at the employee's annual review (Fig. 1).

Fig. 1 Employee compensation breakdown worksheet, based on a model by John McGill (published annually in The McGill Advisory).

Wages include payment for all regular, overtime, vacation, holiday, and sick days. The benefits section includes matching Medicare payments, since Medicare is actually medical insurance for the employee's future. Retirement plan amounts do not include the employee's personal withholding contributions. If your office is generous with benefits, the impact will be seen in the Total Compensation per Hour. The final line on the worksheet shows the annual gain or loss in the value of your employee retirement plan; this is an opportunity to demonstrate how your long-term employees continue to benefit from all your years of contributions to their retirement accounts.

Another key metric is the division of wages between three groups of employees: clerical, clinical, and lab. Clerical employees include office managers, marketing employees, and scheduling/ financial/treatment coordinators (TCs). Clinical employees include chairside assistants, sterilization techs, and any assistants for TCs. Lab employees are those who work exclusively in the office laboratory. The targets for wages as a percentage of collections are 9.5% for clerical, 10.0% for clinical, and 1.2% for lab.

The next metrics to assess are patients seen per assistant per day and exams per TC per month. Determine patients per assistant by dividing the number of patients seen in the practice per day (including those seen by the TCs) by the number of FTE assistants. A target range for patients per assistant is 12-20. Although smaller practices should be able to see 16-20 patients per assistant, larger practices can better utilize doctor time by adding more clinical staff, which will reduce the number of patients seen per assistant per day to around 12-14. Practices that see lots of Phase I patients also have much higher patients-per-assistant numbers.

The TC's responsibilities in new-patient exams include taking records, briefing the patients, presenting all financial arrangements, preparing exam letters to referring dentists, entering initial treatment plans in charts, and following up with patients who left your office without making decisions. The target for new-patient exams per TC per month is 35-40, but that number will be higher if a different employee presents financial arrangements or if your office has a records tech. A TC should also be able to see one or two observation patients per day.

The last metric to look at is the number of hours each doctor spends per week on work that does not involve patient contact. These hours include any working time spent before seeing patients, during lunches, after patient hours, and on weekends. The average orthodontist spends 10-12 hours per week on work outside of patient contact. If you are clocking less than this amount, you are managing your practice well. If your number is more than 15, you should consider more delegation and evaluate your production per FTE to see if you have room to hire more help.

Financial Implications

The best way to use all these metrics is to consider them as a whole. If your production or collections per FTE are only $170,000, for example, delve deeper to see if you are spending excessively in clinical or clerical wages as a percentage of collections. If the clinical figure is high, look at how many patients are seen per assistant. If your production per FTE is $245,000 and you are planning to hire an associate, recognize that your team is already performing at a productive level and will need more FTEs to support the new associate. If your number of patients per assistant per day is less than 12 and your production per FTE is less than $175,000, you will have room to grow without adding employees.

The best-run offices understand both the importance of communication and the implications of employee management metrics. When you study these metrics carefully and act on what you learn, you will be in great shape for healthy long-term team management.

REFERENCES

- 1. Haeger, R.S. and McGill, J.K.: Strategic financial statements for better practice management, J. Clin. Orthod. 48:703-709, 2014.